it really depends on what your investment objective is, and how deep you can go. if you don’t have much experience, and hindi OK sa yo na mawala pera mo, i’ll wait for the market to show signs of an uptake. no one really knows whether / when we will hit rock bottom, and even if the ECQ is lifted, there’s a big question mark on how businesses will rebuild / thrive after this.

MBT looks promising as well. Though ayun nga, di pa natin alam if we sunk na to our lowest…

Overwhelming ang galaw ng market today

Tumataas amidst covid. Some stocks are almost back to their pre-lockdown state

could it possibly be a bull trap? may magaling mag technicals dito eh. hindi nagpaparamdam

Nung bumagsak sa 5400-ish levels medyo nanlumo ako nung umpisa. I entered around 5 or 6 years ago nung nasa 6900 level so ang laki ng lugi diba. Hindi ko binenta kasi buy and hold strategy ko plus may embargo sa office namin.

True, now is the time to buy but I’m observing also. I buy blue chips via COL plus units sa BPI Phil Equity Index Fund. I still keep investing in other lower risk UITFs to balance it out. I try to be consistent through peso cost averaging also.

I bought DITO too. 20% gains na. This is the best time to invest. Bought a thousand shares of JFC at 100-102 two weeks ago. P147 na siya kanina.

Everyday chinecheck ko magkano gains ko hahaha!

Sobrang nakakatuwa kaya bukas mag shopping pa ko blue chips. Yung kinita ng savings account ko in 5 years walang sinabi sa kinita ng stocks ko in 1 week

Actually it’s really not advisable to put more than 6 months emergency fund on savings because you lose on inflation.

Yup. Mas dynamic talaga sa stocks kesa sa savings lang. But just be wary of the trends. Minsan naha-hype lang talaga. Focus on stocks na alam mong mago-grow pa rin after COVID. If may COL Financial account ka, check mo yung Fundamental Analysis nila. Yung mga recommended BUYS nila are usually great kasi backed with reliable data.

Though for day traders, ansarap talaga ng buhay nila now. Hintayan lang sa baba, sell when happy.

latest market outlook from investagrams

might be a good idea to lock in some profits, and get ready for the retest.

Nakakatuwa yung mga learnings dito. I’m super interested mag invest on stocks but I don’t know how. Any tips or suggested reading if I want to start these days? Kakatuwa yung sa Jollibee kasi nung wala pa ECQ, every week may attendance kami doon ng family ko (chickenjoy is  ).

).

Right now kasi savings and insurance (Prulife, 2 FWD, Sunlife, Grepalife) pa lang ang meron kami, wala pa investments other than real properties. Gusto kong matuto kasi baka pwedeng magshift to trading stocks kung matagal pa itong Covid-19 mawala. Medyo scary bumalik sa work kung ilift ang quarantine ng walang mass testing at cure pa.

I use COL Financial and BDO Nomura. They have many materials online for investors, from basics (how to start, etc) to technical charts and reports.

i’ll hold a zoom session on stocks etc (very basic lang) so those interested can PM me

i’ll hold a zoom session on stocks etc (very basic lang) so those interested can PM me

on topic: i was listening to COL’s Juanis B and he was asked nasang part na daw tayo ng Eliott Wave. He replied na wala pa tayo sa Wave B, i.e., there still is an opportunity to buy if di pa nakabili nung nag 4000 plus yung market.

Yeah, transferred yesterday sa COL. Abangers sa target buy below prices.

hey @arwen di kita ma-PM kase naka private profile mo?

I’m interested to join the zoom session. para sa pagyaman hahaha salamat!

If you’re on desktop, you can go to your messages section with the g , m keyboard shortcut. Tapos pag nandun ka na, you can create a new message and add the name of the person you want to message

Ayun. Thank you! May demo pa

Slips today as expected after ecq extension. 5,425 atm. Support at 5,280. Abangers.

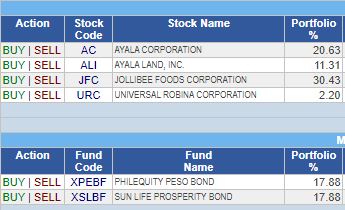

Would love to know how diverse the portfolio of fellow Isko’t Iska.

Here’s mine:

Planning to buy more of AC and URC when trends dictate a good price.

Also, I’m curious to know at what percent you cut your losses or sell your stocks for profit?